DuPage Co. (ECWd) –

Once again, Herricane Graphics and COD can’t seem to come up with documents mandated by law, assuming they are truthful in their response for legally mandated records!

My FOIA request was simple! “Copy of all certified payroll records for all projects contracted to Herricane Graphics”

COD’s answer: Missing from the Herricane Graphics Contract! (click here for contract)

Freedom Of Information Act

First, FOIA states that certified payroll records are public records.

(5 ILCS 140/2.10)

Sec. 2.10. Payrolls. Certified payroll records submitted to a public body under Section 5(a)(2) of the Prevailing Wage Act are public records subject to inspection and copying in accordance with the provisions of this Act; except that contractors' employees' addresses, telephone numbers, and social security numbers must be redacted by the public body prior to disclosure.

Prevailing Wage Act

(820 ILCS 130/4) (from Ch. 48, par. 39s-4)

Sec. 4. Ascertaining prevailing wage.

(a-1) The public body or other entity awarding the contract shall cause to be inserted in the project specifications and the contract a stipulation to the effect that not less than the prevailing rate of wages as found by the public body or Department of Labor or determined by the court on review shall be paid to all laborers, workers and mechanics performing work under the contract.

(820 ILCS 130/4 (a-2) When a public body or other entity covered by this Act has awarded work to a contractor without a public bid, contract or project specification, such public body or other entity shall comply with subsection (a-1) by providing the contractor with written notice on the purchase order related to the work to be done or on a separate document indicating that not less than the prevailing rate of wages as found by the public body or Department of Labor or determined by the court on review shall be paid to all laborers, workers, and mechanics performing work on the project.

No record of prevailing wage compliance

(820 ILCS 130/5) (from Ch. 48, par. 39s-5)

Sec. 5. Certified payroll.

(a) Any contractor and each subcontractor who participates in public works shall:

(2) no later than the 15th day of each calendar month file a certified payroll for the immediately preceding month with the public body in charge of the project. A certified payroll must be filed for only those calendar months during which construction on a public works project has occurred. The certified payroll shall consist of a complete copy of the records identified in paragraph (1) of this subsection (a), but may exclude the starting and ending times of work each day. The certified payroll shall be accompanied by a statement signed by the contractor or subcontractor or an officer, employee, or agent of the contractor or subcontractor which avers that: (i) he or she has examined the certified payroll records required to be submitted by the Act and such records are true and accurate; (ii) the hourly rate paid to each worker is not less than the general prevailing rate of hourly wages required by this Act; and (iii) the contractor or subcontractor is aware that filing a certified payroll that he or she knows to be false is a Class A misdemeanor. A general contractor is not prohibited from relying on the certification of a lower tier subcontractor, provided the general contractor does not knowingly rely upon a subcontractor’s false certification. Any contractor or subcontractor subject to this Act and any officer, employee, or agent of such contractor or subcontractor whose duty as such officer, employee, or agent it is to file such certified payroll who willfully fails to file such a certified payroll on or before the date such certified payroll is required by this paragraph to be filed and any person who willfully files a false certified payroll that is false as to any material fact is in violation of this Act and guilty of a Class A misdemeanor.

The public body in charge of the project shall keep the records submitted in accordance with this paragraph (2) of subsection (a) before January 1, 2014 (the effective date of Public Act 98-328) for a period of not less than 3 years, and the records submitted in accordance with this paragraph (2) of subsection (a) on or after January 1, 2014 (the effective date of Public Act 98-328) for a period of 5 years, from the date of the last payment for work on a contract or subcontract for public works.

The records submitted in accordance with this paragraph (2) of subsection (a) shall be considered public records, except an employee’s address, telephone number, and social security number, and made available in accordance with the Freedom of Information Act. The public body shall accept any reasonable submissions by the contractor that meet the requirements of this Section.

A contractor, subcontractor, or public body may retain records required under this Section in paper or electronic format.

You guessed it!

No certified payroll from Herricane Graphics according to the most recent Freedom of Information Act request! (Click here for copy of FOIA request & response from COD)

Is the no bid contract with Herricane Graphics now an official scandal at COD?

5 Comments

Edward Franckowiak

Posted at 21:54h, 18 JanuaryThis seems like HG has problems with contracts.

http://caselaw.findlaw.com/il-court-of-appeals/1259949.html

Edward Franckowiak

Posted at 05:15h, 19 JanuaryKirk,

Isn’t COD obliged to get this data from Herricane Grafics under 5 ILCS 140/7(2)?

(2) A public record that is not in the possession of a public body but is in the possession of a party with whom the agency has contracted to perform a governmental function on behalf of the public body, and that directly relates to the governmental function and is not otherwise exempt under this Act, shall be considered a public record of the public body, for purposes of this Act.

Thanks,

Ed Franckowiak

jmkraft

Posted at 06:59h, 19 JanuaryYou are correct.

Kirk Allen

Posted at 08:34h, 19 JanuaryEdward,

Yes, COD is obligated by law to get those records from HG. It is not the FOIA requester obligation to inform them of that. They chose to simply claim they dont have any so we are covered by claiming they did not comply with the prevailing wage law. That law itself outlines they are public records subject to FOIA and lists the allowable exemptions as well

Ted Hartke

Posted at 15:51h, 19 JanuaryI think Certified Payroll can also be used by agencies to check numerous things such as:

-making sure prevailing wages are being paid vs. minimum wages.

-making sure contract prices are in-line with the actual construction cost

-making sure the workers are eligible to work (citizenship, child labor, etc.)

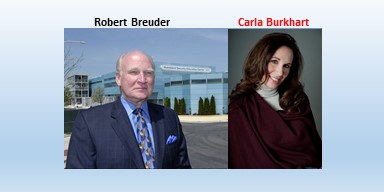

-making sure FRAUD is not occurring, such as making sure the human beings who are being paid actually exist. For instance, I think someone could use the information to make sure dead people and/or children of business owners are not receiving wages for doing nothing. The dollar amount paid to Herricane Graphics seems excessive. They are certainly not eligible to be classified as professional services, since Herricane Graphics is not a professional design firm or have any architects, engineers, or surveyors on their payroll. HG needs to return the money or be charged with fraud, charged with mail fraud, and complaints filed with the Illinois Dept of Professional Regulation against Carla Burkhart for representing herself as an architect. Other architects should be up in arms about this.

I think the ECWd or other groups should look to see if COD is following the QBS process, which is a way to ensure qualified professionals are providing the needed services.