The following information was sent to us by Randy Peterson:

It is a Press Release from the Chapin Rose office.

I should state that Representative Brad Halbrook also Opposes the Pension Cost-Shift

=================================

NEWS RELEASE

For Immediate Release Contact: Chapin Rose 217-621-2244

Thursday, October 25, 2012

Rep. Rose Opposes Pension Cost-Shift Plan

Exposes Huge Discrepancy in Property Taxes Paid by Chicago Leaders vs. Downstate Citizens

“Why should a citizen in Paris pay $4100 more in property tax than Madigan?”

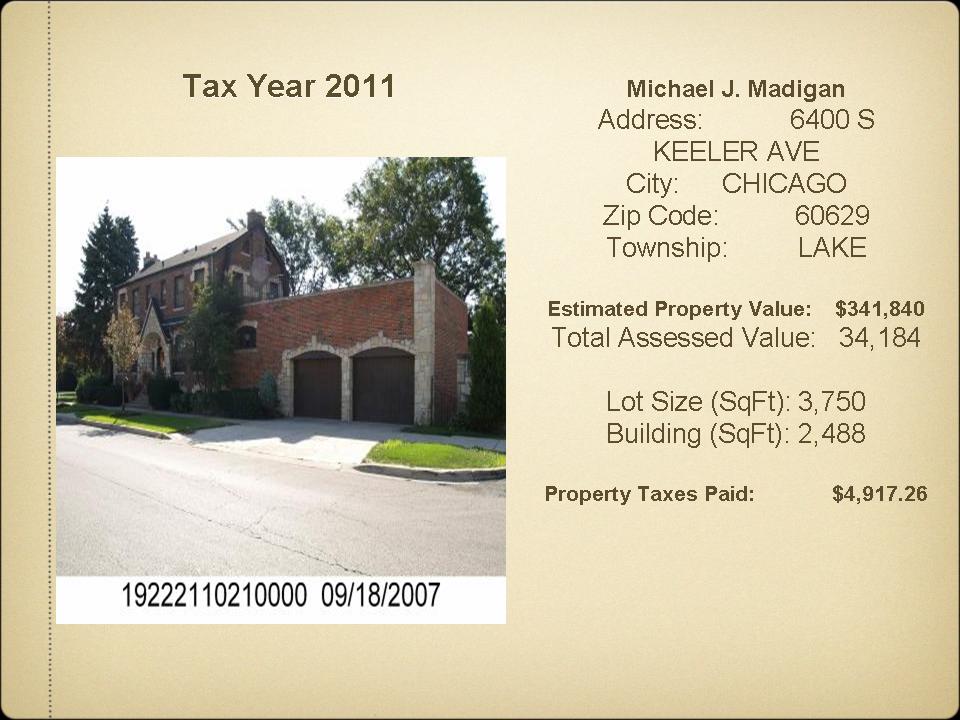

Paris – Today, State Representative Chapin Rose released data showing a large disparity between what local citizens of Edgar County pay on their property taxes and what Speaker Madigan and Governor Quinn – both from Chicago pay on their own bills. Rep. Rose made his announcement in the context of the Quinn/Madigan/Cullerton plan to “downshift” state teacher pension debt onto local school districts.

The plan pushed by the Democrat leaders of the Illinois House, Senate, and the Democrat Governor would shift, at least, $700 million a year onto local school budgets. Downstate schools, in turn, would be forced to choose between massive cuts in the classroom, raising local property taxes, or both.

In analyzing the plan outlined by Democrat Leaders, Rep. Rose compared what we pay in downstate Illinois versus what these same leaders paid in Chicago. Releasing the data today, Rep. Rose uncovered the fact that local citizens currently pay thousands more than either the Speaker or the Governor in property tax.

“Speaker Madigan pays less than $5,000 on a $350,000 property in Chicago. The same piece of property in Chrisman would pay $3500 more! A Senior citizen in Paris would pay a whopping $4100 more than Madigan! All of downstate Illinois should be up in arms about this outrageous disparity – particularly since these are the same people who now want to raise your property taxes with the pension ‘shift’ plan,” said Rep. Rose.

“Team Chicago has indicated that they may call this bill for a vote in the lame-duck veto session that begins next month. It is imperative that downstate Illinois stick together on this – and oppose the shift,” Rep. Rose concluded.

Editor’s Note: Attached is a picture of Speaker Madigan’s home from the Cook County Assessor’s office – note it is only assessed at $341,840.00. Also, attached is a spreadsheet detailing how much more citizens would pay on a similar piece of property in Edgar County than either Speaker Madigan or Governor Quinn. Column “D” includes the local tax rates as provided by the County Treasurer’s office (for parcels located within city limits). Column “F” is what Madigan/Quinn actually paid in Chicago. Column “G” is the difference (“how much more”) the local County resident would pay than Madigan/Quinn. (Coles County information here)

###

No Comments

Sorry, the comment form is closed at this time.