Shelbyville, IL. (ECWd) –

“We reviewed the statement of facts and supporting documentation and determined that this property does not meet the exemption qualifications for the following reason or reasons:”

- “The property is not in exempt use.”

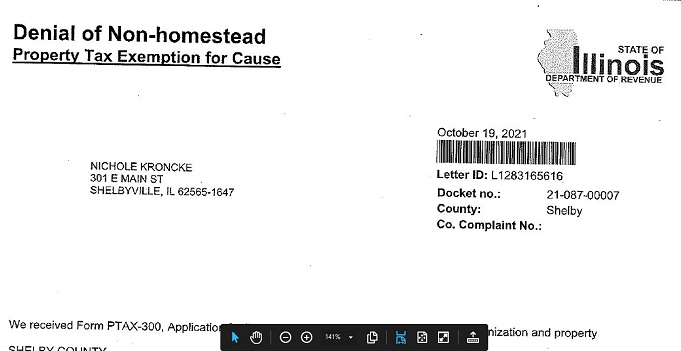

The Illinois Department of Revenue denied Shelby County’s request for tax exemption of its farmland.

The Shelby County State’s Attorney and the Shelby County Board of Review petitioned the Illinois Department of Revenue for tax exempt status of the county-owned farmland. The county has owned this property since 1867.

As we expected, the IDOR denied tax exempt status of that land.

Now the county taxpayers must pay the real estate taxes of the county-owned land.

20211021154322554

4 Comments

PK

Posted at 19:02h, 24 OctoberCollectively, the board stubbornly votes to hold a view to profit from the poor farm; because, at some point in the last generation, the county went from the intent of a “poor farm” to another that seeks to profit for the county’s coffers.

{Retracting sarcasm}

The claim could be valid if the future use is with clarity on public purpose and without a view to profit. Evidence to present on appeal could be a board resolution that spells that out, I believe.

d dah

Posted at 15:13h, 24 OctoberFarm land is vacant land!

Kirk Allen

Posted at 07:53h, 24 OctoberFuture use undetermined? The board has made it clear they want it farmed. How is claiming future use undetermined?

PK

Posted at 13:53h, 22 OctoberSurely there would be a lack of evidence to present for an administrative appeal!