Shelbyville, IL. (ECWd) –

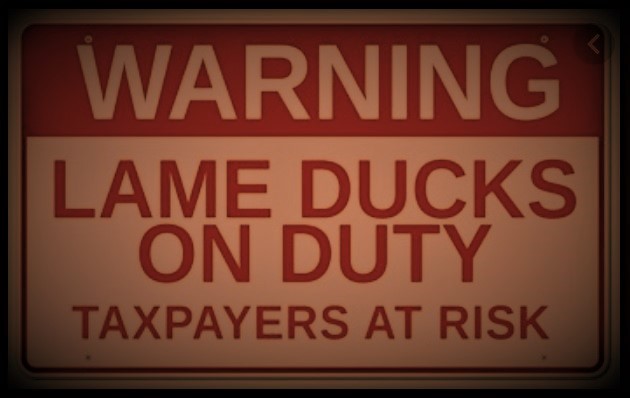

Lame-duck sessions of the Shelby County Board might get interesting – the Chairman was ousted in the primary election (garnering only around 25% of the vote) and is apparently seeking revenge during his last month, and Board Member LeVonne Chaney was ousted by the people at the general election having only obtained 37% of the vote and is now trying to stick it to taxpayers to pay other people’s private property taxes on her way out the door.

It is common knowledge to everyone except certain Shelby County Board Members that leaseholders of real estate leased from a public entity (Shelby County) are responsible for real estate taxes, and receive the tax bills for that leased real estate.

It is also common knowledge to nearly everyone, except for certain Shelby County Board Members that NO lien may be placed on exempt public property for unpaid or delinquent real estate taxes. Therefore, that exempt property cannot be sold at a tax sale.

It should also be common knowledge that Shelby County public (taxpayer) funds cannot be used to pay the real estate taxes of private persons (the farmers who lease farmland from Shelby County). (Illinois Constitution, Art. VIII, Sec 1(a) and (b))

Don’t believe it? Read what the law says about it:

By default, public property is exempt . . . unless leased out:

(35 ILCS 200/15-10)

Sec. 15-10. Exempt property; procedures for certification.

(a) All property granted an exemption by the Department pursuant to the requirements of Section 15-5 and described in the Sections following Section 15-30 and preceding Section 16-5, to the extent therein limited, is exempt from taxation. In order to maintain that exempt status, the titleholder or the owner of the beneficial interest of any property that is exempt must file with the chief county assessment officer, on or before January 31 of each year (May 31 in the case of property exempted by Section 15-170), an affidavit stating whether there has been any change in the ownership or use of the property . . .

EXEMPT:

(35 ILCS 200/15-60)

Sec. 15-60. Taxing district property. All property belonging to any county or municipality used exclusively for the maintenance of the poor is exempt, as is all property owned by a taxing district that is being held for future expansion or development, except if leased by the taxing district to lessees for use for other than public purposes.

IF public exempt property is leased out, the public body MUST:

(35 ILCS 200/15-20)

Sec. 15-20. Notification requirements after change in use or ownership. If any property listed as exempt by the chief county assessment officer has a change in use, a change in leasehold estate, or a change in titleholder of record by purchase, grant, taking or transfer, it is the obligation of the transferee to notify the chief county assessment officer in writing within 90 days of the change. If mailed, the notice shall be sent by certified mail, return receipt requested, and shall include the name and address of the taxpayer, the legal description of the property, the address of the property, and the permanent index number of the property where such number exists. If notice is provided in person, it shall be provided on a form prescribed by the chief county assessment officer, and the chief county assessment officer shall provide a date stamped copy of the notice. Except as provided in item (6) of subsection (a) of Section 9-260, item (6) of Section 16-135, and item (6) of Section 16-140 of this Code, if the failure to give such notification results in the assessment officer listing the property as exempt in subsequent years, the property shall be considered omitted property for purposes of this Code.

(Source: P.A. 96-1553, eff. 3-10-11.)

AND the public body must also:

(35 ILCS 200/15-15)

Sec. 15-15. Obligation to file copies of leases or agreements. If any property listed as exempt by the chief county assessment officer is leased, loaned or otherwise made available for profit, the titleholder or the owner of the beneficial interest shall file with the assessment officer a copy of all such leases or agreements and a complete description of the premises, so the chief county assessment officer can ascertain the exact size and location of the premises in order to create a tax parcel. Failure to file such leases, agreements or descriptions shall, in the discretion of the chief county assessment officer, constitute cause to terminate the exemption, notwithstanding any other provision of this Code.

(Source: P.A. 87-895; 87-1189; 88-455.)

AND LEASEHOLDER is responsible for the taxes AND there can NEVER be a lien on the exempt real estate:

See page 32 (last sentence of first paragraph) for who the tax bill is mailed to: “The tax bill is mailed to the property owner or the person in whose name the property is taxed.”

Sec. 20-5. Mailing or e-mailing tax bill to owner.

(a) Every township collector, and every county collector in cases where there is no township collector, upon receiving the tax book or books, shall prepare tax bills showing each installment of property taxes assessed, which shall be filled out in accordance with Section 20-40. A copy of the bill shall be mailed by the collector, at least 30 days prior to the date upon which unpaid taxes become delinquent, to the owner of the property taxed or to the person in whose name the property is taxed.

According to the Illinois Department of Revenue (see page 6), “Leaseholders pay property taxes on real property leased from an owner whose property is exempt (e.g., the state owns agricultural property and leases it to a farmer).”

Sec. 9-195. Leasing of exempt property.

(a) Except as provided in Sections 15-35, 15-55, 15-60, 15-100, 15-103, 15-160, and 15-185, when property which is exempt from taxation is leased to another whose property is not exempt, and the leasing of which does not make the property taxable, the leasehold estate and the appurtenances shall be listed as the property of the lessee thereof, or his or her assignee. Taxes on that property shall be collected in the same manner as on property that is not exempt, and the lessee shall be liable for those taxes. However, no tax lien shall attach to the exempt real estate. The changes made by Public Act 90-562 and by Public Act 91-513 are declaratory of existing law and shall not be construed as a new enactment. The changes made by Public Acts 88-221 and 88-420 that are incorporated into this Section by Public Act 88-670 are declarative of existing law and are not a new enactment.

There is no provision in the Counties Code for a county to vote to use taxpayer funds to pay another person’s real estate taxes – but this is what LeVonne Chaney is wanting the Board to approve while she and the Chairman are lame-ducks on their way out the door.

Chaney also thinks the county real estate can be sold at a tax sale for unpaid taxes, but she is wrong again (see Sec 9-195 of the Property Tax Code): “However, no tax lien shall attach to the exempt real estate.“

2 Comments

Cindy

Posted at 15:00h, 06 NovemberI don’t understand how these folks can get up and attest that “I make good decisions.” while wearing a Satanic mask and then pulling it down to speak. (Exactly what purpose does it serve to wear something so dangerous to your health and then compromise the whole idea of the wearing it!) Who are these morons that think they make good decisions? They just showed you by their assanine actions that they don’t have an ounce of common sense. Board members are never there to help anyone.

PK

Posted at 21:13h, 05 NovemberWith perseverance and a southerly breeze off the lake, these lame ducks ware soon to have no flock at all. Honk honk, Edgar County Watch.