COLES CO., IL. (ECWd) –

Coles County “Commercial Assessor” is actually a Contractor – not an Employee, and has never been properly contracted with, nor properly appointed.

We now have positive proof that the Commercial Assessor, Robert Becker, used by the Supervisor of Assessments in Mattoon Township is not an “employee” of the SOA and never has been. He is a “contractor” performing the work of the SOA, in which neither the SOA nor the county board had the authority to contract with.

At the April 2017 Coles County Board meeting, the State’s Attorney, County Board Chairman, and Supervisor of Assessments, all claimed several things when questioned on Becker’s authority to conduct assessments, the board’s authority to contract with him, and the SOA’s authority to contract or hire him as an employee.

During public comment, the following happened:

- The claim was made that there never was a “contract” with Becker, and therefore he could not be a “contractor”

- The claim was made that his submission of, and the board’s approval of, a “proposal”, was exactly that – approval “of the submission of” the proposal by Becker and did not constitute a contract nor acceptance of the conditions contained in the proposal

- The SOA and SA claimed Becker was hired as an employee of the SOA’s office

Here are the problems with the above statements made by Coles County officials:

- The county previously claimed, or alluded to his proposal being a contract and even provided a copy of it when asked for the contract – only when we wrote about the SOA not having statutory authority to contract with someone to perform her statutory duty did the county’s story change

- When asked about Becker’s employment status or part-time or full-time, the SOA said “part-time” – however, the SOA does not have the statutory authority to hire (appoint) any employees without first obtaining “advice and consent” from the county board

- Additionally, the board has to set any SOA employee compensation – the county board never advised and consented to Becker’s hire (appointment) and never set his compensation

- Becker uses software purchased by the county, he uses a county computer to access the software, and uses the computer in an office owned by the county

- Becker “invoices” the county for work performed – Do employees invoice their employers? No.

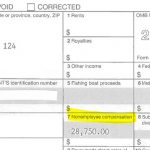

- Becker received IRS Form 1099, which annotates “nonemployee compensation” – is that the proper reporting to the IRS for employees of a public body? No.

- There are certain statutory provisions spelling out who has statutory authority to conduct assessments (see this article)

2 Comments

Frank Rizzo

Posted at 23:35h, 01 MayMy accountant is always telling me the IRS has rules!

One time he was telling me about this guy who got nailed for mis-classifying all his employees as independent contractors. Thought he was saving some money and then WHAM! 20 questions he didn’t want to answer with the examiner and he gets hit with a YOOGE penalty!

The poor joker found out the IRS has rules about this kind of stuff. Who knew?

So just cause they have a 1099 don’t necessarily make ’em one of them independent contractors in the eyes of the tax man!

Edna Crabapple

Posted at 23:35h, 29 AprilI don’t doubt that you have to put up with lots of “eluding” from the politicians but “alluding” would work pretty good there too.