EDGAR CO. –

At a time when property taxes increased by over 100% for some property owners in Edgar County, the Edgar County Watchdogs are still finding property where no tax is being assessed. The latest piece came to us by accident while we were waiting for the monthly Animal Control meeting to begin. Several people were looking at the waste-high weeds next to a corn field that belongs to the Edgar County Cemetery Association and I decided to check to see if taxes were being paid on the property. Of course, knowing how things operate in this county, we already knew the answer before looking at the records in the assessors office.

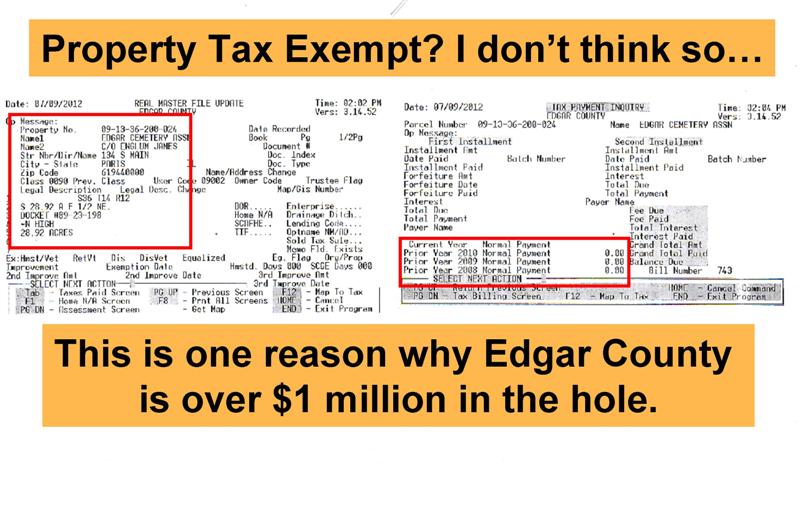

Edgar County Cemetery Association

After obtaining the tax records from the treasurer, our suspicions were verified. Taxes were not being paid. Property owned by the Edgar County Cemetery Association is tax exempt property, UNLESS they lease it out – as the case with farmland on North High Street. Generally speaking, the Illinois Property Tax Code states exempt property, once leased, is treated as nonexempt property- with the leaseholder (the farmer in this case) responsible for property tax payments.

No Surprise after City of Paris Transfer Station and Ingrum Waste

This should not come as a surprise to the Edgar County Board, as we raised the issue in their April 2012 meeting, where I talked about Edgar County leased property that is taxable and the fact that the county is wanting to pay the property taxes on the property instead of the leaseholders. I also talked about the discovery I made with the City of Paris property (Transfer Station lease to Ingrum Waste) that has been listed as tax exempt, when in fact it was leased – again no property taxes paid to the county as there should be. I talked about the fact the City of Paris has been submitting false certificates of tax exempt status to the county assessor. The signature of the city attorney at the bottom verifies the information provided is true – in this case it turned out to be false. The same issue was brought to them prior about the farm and hangar leases at the Edgar County Airport.

Assessors, County Board

One has to wonder if the assessors are properly serving the People, townships, and county by allowing certain properties to go untaxed. Where is the oversight? It is my belief, the County Board should immediately require a complete records and property inspection of all property reported as tax exempt property – and seek the prosecution of those submitting false or incomplete paperwork to the assessor.

Role of the Board of Review

The Board of Review is responsible for assessing all property that was omitted from the assessment books. Leased property falls under this catagory when it is identified as not currently being assessed.

To approve all Homestead Exemptions

To ensure all assessments are equitable within the county and townships…

To hear valuation complaints and adjust assessments on their own inititative after property owner has been notified and given an opportunity to respond.

Official Notifications Sent

In the past couple of weeks, I have sent two notifications to the County Assessor and to each county board member requesting that certain properties be immediately listed, assessed by the board of review, and a tax bill sent that included the current year and the past three years – as the law allows. You can view these documents here:

No Comments

Sorry, the comment form is closed at this time.